New Delhi, India – 31-08-2025 – BizPlan AI Pro, an AI-powered business plan generator, has launched an India-specific version to support entrepreneurs, startups, and small businesses across India. The updated platform supports 15+ Indian regional languages—including Hindi, Tamil, Telugu, Bengali, Marathi, Kannada, Malayalam, Gujarati, and Punjabi—making it the first AI business planning tool tailored to India’s linguistic diversity and allowing users to create investor-ready business plans in their preferred language.

India boasts one of the world’s most vibrant startup ecosystems. By supporting regional languages, we ensure that no entrepreneur is left behind due to language barriers,” said sdeb, Founder of BizPlan AI Pro. “Whether you’re a farmer in Tamil Nadu, a small shop owner in Kolkata, or a tech innovator in Bengaluru, BizPlan AI Pro can now help you create a professional business plan in your mother tongue.”

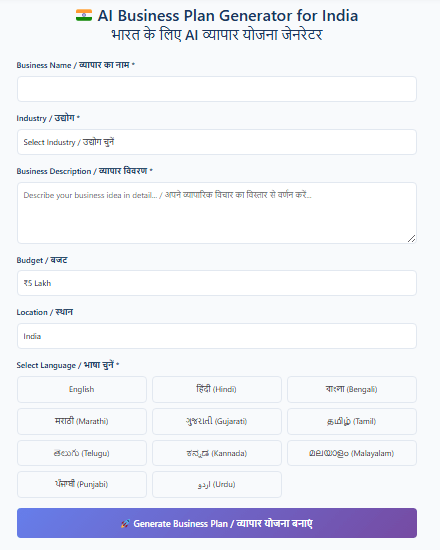

BizPlan AI Pro (Indian version) — Key Features

- Multi-language support: Create business plans in Hindi, Tamil, Telugu, Bengali, Marathi, Kannada, Malayalam, Gujarati, Punjabi and other Indian languages.

- AI-driven strategy: Step-by-step guidance for idea validation, funding needs, competitor analysis, financial projections, and go-to-market plans.

- Localized templates: Ready-made frameworks tailored to Indian sectors like retail, agriculture, manufacturing, SaaS, education, and healthcare.

- Investor-ready outputs: Export professional reports in PDF, DOCX, and PPT formats.

- Affordable and flexible: Credit-based pricing designed for Indian entrepreneurs and MSMEs.

Why it matters

India has over 65 million MSMEs and a fast-growing startup ecosystem. Still, many founders struggle with professional documentation in local languages. BizPlan AI Pro fills that gap with localized, AI-powered business plans that help entrepreneurs secure funding and scale.

Availability

The Indian version of BizPlan AI Pro is available now at www.bizplanaipro.in

Media Contact:

Sdeb

Founder & CEO – BizPlan AI Pro

📧 Email: media@bizplanaipro.com

🌐 Website: www.bizplanaipro.com